So, you’re buying a house, and of course, the real estate industry tells you it’s easy: just sign on with a buyer agent, and they’ll do everything for you.

But wait—before you sign anything, consider this: not all buyer agents are created equal, in fact there are huge differences in buyer agents and the brokerages they work for.

If you’re not careful, you will probably end up with someone who doesn’t have your best interests at heart, or someone who doesn’t have the experience and wisdom to help you make good buying decisions.

Here are five critical things to look for before signing a buyer agent agreement—because getting stuck with the wrong agent could cost you big.

1. Proof of Past Success

First off, let’s talk about track records. Real estate agents love to say they’re experts, but what have they actually done? Look, it’s not enough for them to smile and assure you they’re experienced—demand proof.

How many homes have they helped buyers purchase in your market?

Can they show you specific examples of deals where they saved buyers money? Sometimes you’ll need to ask probing questions about their past.

Ask for an example of how they’ve helped a buyer win a “bidding war” without paying more money that a competing buyer. (There are at least six answers to that question.) Ask them how they’ve saved a buyer money on other services that home buyers require during a transaction. (For the last thirty years there were seven specific areas where serious buyer agents have been looking to save buyers money, but one of those is no longer possible so now there are really only six.) Ask them how they’ve worked through inspection related issues on a recent purchase. (There are four different ways to handle those. Every serious buyer agent should be able to describe those, even if they are half asleep.)

Pay attention to their answers, because you don’t want to choose an agent who will be gaining their experience on your transaction.

2. Negotiation Skills and Training

Now, negotiation is where things really matter. Real estate agents are supposed to be your advocate, negotiating to get you the best price and best terms. But here’s the reality: many agents aren’t trained negotiators. It’s shocking, I know. Have they had any formal negotiation training? Ask them directly.

When I met my wife she had just gotten her real estate license and was helping home buyers. I was facinated that she had zero negotiation training. When she told me her office didn’t have negotiation training I thought she must be joking. She wasn’t. That office is now part of a huge regional company with multiple brands, their own mortgage company, their own title companies and a large market share in this area.

In a competitive housing market, the difference between a skilled negotiator and an amateur can mean thousands of dollars out of your pocket. Don’t settle for an agent who can’t explain how they’ll fight for you during your negotiations.

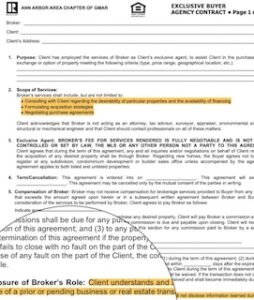

Example Contract Agreement

3. Loyalty to the Buyer

This one should be obvious, but trust me, it’s not. Many agents and their companies represent both buyers and sellers. That’s called dual agency, and it’s a conflict of interest. They’ll say it’s perfectly legal—and it is in Michigan—but it’s never in the best interests of you as a home buyer.

Whose side are they really on? You need an agent whose loyalty is entirely with you, not someone advertising to sellers and claiming to get seller’s homes sold at the highest price. Ask upfront: are you representing me and only me? If they can’t answer with a clear “yes,” move on.

4. Ability to Evaluate Homes

Sure, agents love to point out shiny countertops and trendy fixtures, but can they actually evaluate the value of a home? The right buyer agent will walk you through the house with a critical eye. They’ll be able to discuss the ten critical location characteristics, spot potential problems—foundation issues, discuss old plumbing, and potential association issues, all things that could cost you thousands later. And agent should be able to tell you about the two breakpoints in the residential building science curve.

If your agent is too busy selling you on the decor and isn’t looking at the structure, you’ve got a problem.

5. The Ability to Shop and Negotiate Mortgages

Finally, let’s talk mortgages. Most buyers focus only on the house price, but your mortgage is just as important—if not more so. The right agent will help you shop around for the best mortgage rates, not just take the first offer that comes along. They should know how to compare lenders and negotiate terms. If your agent isn’t talking about this part of the process, they’re doing you a disservice.

Conclusion

Look, buying a home is one of the biggest financial decisions you’ll ever make. Don’t let a bad buyer agent cost you more than you bargained for. Be skeptical. Ask tough questions. And if they can’t prove they’re the right person for the job—find someone who can. You deserve it.